Disruptors News. Vertical Aerospace Makes History while Draganfly Soars 100%

Flying taxis take off, a forgotten drone stock explodes, the AI infrastructure battle heats up, and a new Palantir endeavor takes shape.

WeRide Hits Major Milestone with Southeast Asia’s First Fully Driverless Robobus Service

Autonomous vehicle pioneer WeRide (WRD) just launched Southeast Asia’s first truly driverless Robobus at Singapore’s Resorts World Sentosa — operating without a safety officer onboard. This isn’t a test ride. It’s fully approved by Singapore’s Land Transport Authority after a full year of incident-free operation.

The Robobus, now running a fixed 12-minute loop across major hotel hubs at RWS, has logged thousands of successful trips and transported tens of thousands of passengers since mid-2024. Backed by LIDAR, sensors and cameras, the vehicle has maintained a spotless safety record.

This is a massive greenlight for WeRide’s expansion plans and a vote of confidence in AV infrastructure in Southeast Asia. It also adds momentum to the global push toward fully autonomous public transit.

That said, the market doesn’t seem fully convinced yet. WRD is still down 38% YTD — maybe a reflection of broader skepticism toward Chinese robotaxi startups or just the usual China discount investors apply these days. Pony.ai is also down 13% YTD.

Only a handful of analysts even cover WRD. The most recent price target came last month from Morgan Stanley’s Tim Hsiao, who set a $13 target with a 'Buy' rating. That’s a projected 48% upside — but there hasn’t been much fresh Wall Street chatter since.

WRD shares are up 1.7% on the news.

EVTL Just Made History With a Full-Scale Air Taxi Flight

Vertical Aerospace ($EVTL) pulled off a big one — the world’s first airport-to-airport flight with a full-scale piloted eVTOL aircraft. No test loop. No hover demo. This was a legit 17-mile hop from Cotswold Airport to RAF Fairford at 1800 feet and 115 mph.

The VX4 prototype is officially airborne and operational under real-world conditions, thanks to full UK Civil Aviation Authority approval. The aircraft even landed in front of thousands of spectators ahead of this weekend’s Royal International Air Tattoo — the world’s biggest military air show.

This might sound like a PR milestone, but it’s more than that. The first public landing of a crewed air taxi at an actual airfield is a huge box checked on the road to certification and commercial rollout.

With JOBY making waves in the US and WRD lighting up Singapore, this is the UK throwing its own hat in the urban mobility ring — and EVTL is finally getting noticed.

Needham sets $9 price target implying 50% upside

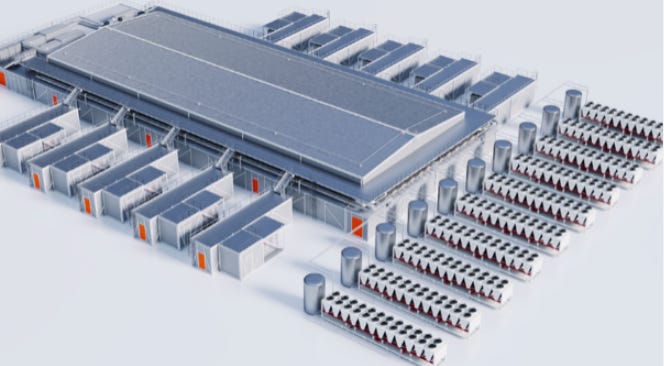

Vertiv Makes a Strategic Play for the AI Data Center Race

Vertiv (VRT) is spending $200 million to acquire Great Lakes, a Pennsylvania-based maker of data racks and enclosures — the kind of gear that keeps AI servers cool and organized. It’s a move to bulk up its infrastructure offering just as AI demand explodes.

Great Lakes brings deep experience in custom rack systems, with U.S. and European manufacturing. The deal, valued at 11.5x expected 2026 EBITDA, is all about scale and vertical integration — giving Vertiv more control over supply chains and thermal efficiency.

The timing is interesting: a few days before the announcement, VRT stock dropped nearly 10% on rumors that Amazon was switching to in-house data center solutions.

With this acquisition, Vertiv is signaling it’s ready to fight for its share of the AI buildout. The deal is expected to close later this year.

BofA raised PT to $150 from $140

Draganfly’s 'Swiss Army Drone' Lands a DoD Deal

Draganfly (DPRO) just scored a contract with a major U.S. Department of Defense branch for its Commander3 XL drone platform — a customizable UAV built for intelligence, surveillance, and reconnaissance (ISR) missions.

Nicknamed the “Swiss Army Knife” of drones, the C3XL is known for its flight stability, modular payload options, and adaptability across defense, security, and emergency response operations. The deal was made through a prime contractor, with Draganfly working directly with military stakeholders to tailor the platform.

Draganfly isn’t a new name — during the pandemic, the stock spiked above $300 before crashing back to earth, like many small-cap defense-tech names. It’s been quiet since, but this latest DoD win could put it back on radar.

The company’s market cap sits around $35 million today — a far cry from its pandemic highs — but the Pentagon’s nod suggests there’s still some fight (and flight) left in the name.

No financials were disclosed, but this marks another defense win in the growing drone-tech race.

Palantir Cracks Into Clinical Trials with Velocity Partnership

Palantir (PLTR) just landed a fresh partnership with Velocity Clinical Research, aimed at fixing one of the most annoying and inefficient parts of clinical trials: payments reconciliation. Think invoices flying between sites, sponsors, CROs — all in different systems, often handled manually.

The solution? Palantir’s AI workflows now plug into Velocity’s backend to automate this chaos. Early results already show fewer errors and more time freed up for high-value work.

It may not be the flashiest news, but it’s a solid example of Palantir embedding itself deeper into healthcare operations. That’s the real goal — become the invisible backend for high-friction industries.

PLTR shares rose 0.67% on the news.

The Edge of Power

Your edge before the Bell