Figma’s IPO Is Coming — But a Low-Key Chinese Stock Is Already Up 100%

Sigma is going public — but the real story is who’s quietly buying up battery makers, and how you can ride the wave

Crypto stocks extend rally after Genius Act

Crypto-related equities are ripping higher after Trump officially signed the Genius Act — a landmark bill that creates a regulatory framework for stablecoins. The market clearly sees it as a greenlight for broader institutional participation.

$SBET +9% after falling 20% on Friday

BMNR +6% — Bitminer is one of the lesser-known but fastest-moving plays in the crypto equity space. The company runs mining operations optimized for energy efficiency and has been aggressively expanding into North America. It also recently caught attention after Peter Thiel disclosed a stake, sending a strong signal of long-term belief in the space.

Galaxy Digital (GLXY) +11.8%

XYZ +9%

It’s not just policy driving the move. Block (SQ), which holds 8,584 BTC on its balance sheet, is also running — boosted by its recent inclusion in the S&P 500 index. That ETF tailwind alone could push passive flows into the stock for weeks.

This could mark the beginning of a more sustained crypto-equity breakout — especially with rates expected to fall and Trump campaign promises energizing retail.

Figma sets IPO terms, targets $13.7B valuation

Figma, the cloud-based design platform Adobe once tried to buy for $20B, is going public. The company plans to raise up to $1.03 billion in its U.S. IPO, aiming for a valuation of up to $13.65 billion.

Around 37 million shares will be offered, priced between $25 and $28. The listing will take place on the NYSE under the ticker FIG. Underwriters include Morgan Stanley, Goldman Sachs, Allen & Co, and J.P. Morgan.

Why it matters:

– This is the biggest design-focused tech IPO since Adobe’s failed acquisition

– A successful offering would signal investor appetite for new listings is back

– Figma could become a bellwether for the next wave of high-growth SaaS IPOs

Adobe was forced to walk away from the $20B deal in 2023 after regulators in the U.S. and EU raised antitrust concerns, arguing the merger would harm competition in the design software market. With Figma now listing independently, Adobe gets no upside — only a reminder of the acquisition it couldn't close.

Adobe shares, already one of tech’s worst performers this year, risk further underperformance as Figma becomes a standalone competitor with public-market firepower.

Battery Stocks Are On Fire — And ABAT Leads the Charge

American Battery Technology Company ($ABAT) is up 95% over the past month, riding the wave of renewed investor interest in U.S.-based battery manufacturing. The Nevada-based firm focuses on lithium-ion battery recycling and primary lithium extraction — two areas now considered strategically vital by Washington.

📦 Why it matters: As the U.S. government accelerates its efforts to shift critical supply chains away from China, battery metals like lithium are becoming geopolitical assets. ABAT is positioned at the intersection of this trend — recycling old batteries and extracting new lithium from domestic sources.

🧠 Who's behind it: BlackRock owns more than 5% of the company, a strong signal of institutional conviction. This is the BlackRock — the world’s largest asset manager with $10 trillion under management, not to be confused with private equity giant Blackstone. BlackRock often aligns its capital with government-aligned industrial policies, and its involvement here suggests ABAT is more than just a speculative bet.

📈 Part of a bigger move: Other battery names are also ripping:

$AMPX +34% this week

$QS +58%

$MP +40%

The market is repricing U.S.-based lithium and battery firms amid increasing talk of reshoring and resource security.

💡 The bigger picture: This isn’t just about batteries. It’s a realignment of industrial strategy — and early buyers of overlooked U.S. producers may end up holding the keys to America’s next manufacturing boom.

IonQ Taps Intelligence Veteran to Lead Quantum Push — 2M Qubits by 2030?

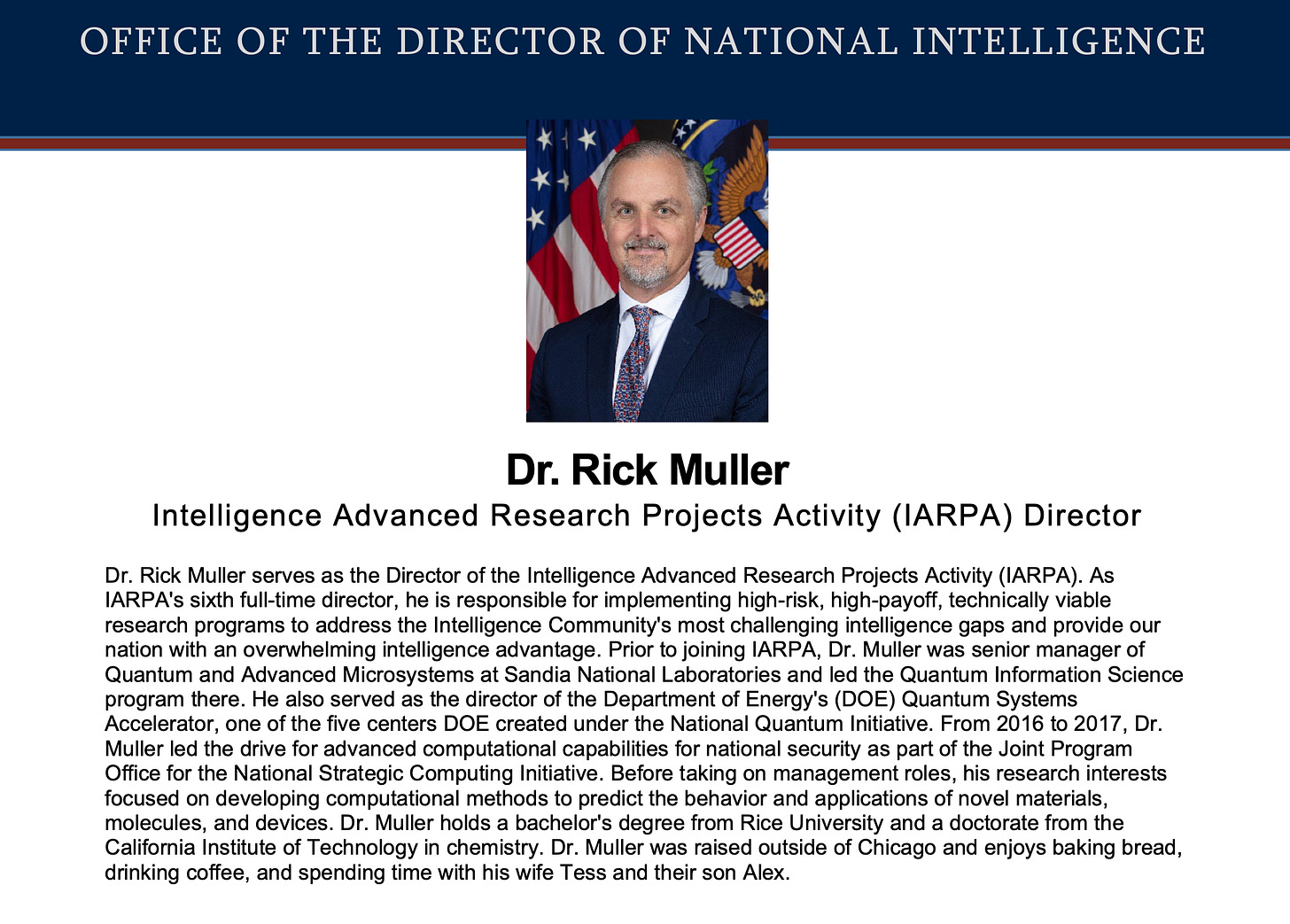

IonQ ($IONQ) just hired Dr. Rick Muller — a major name in U.S. intelligence research — as VP of Quantum Systems. He’ll now be in charge of building the company’s next-gen computing stack, with one goal: scale up to 2 million qubits by the end of the decade.

Muller ran the Intelligence Advanced Research Projects Activity (IARPA), the U.S. intel community’s answer to DARPA, and led national-scale programs in quantum computing, AI, biometrics, and advanced systems architecture. His background also includes senior roles at Sandia Labs and the DoE’s Quantum Systems Accelerator.

IonQ is going from science project to national infrastructure.

“His track record in high-impact R&D is exactly what we need to secure operational quantum advantage,” said IonQ’s SVP of Engineering.

The company is now positioning itself as a trusted partner not just for commercial quantum work — but for federal applications too. This move places IonQ in direct alignment with long-term national goals in quantum defense and AI.

The market hasn't reacted yet, but this could be a turning point for $IONQ — if they can back the headline with engineering progress.

Keep reading with a 7-day free trial

Subscribe to Edge of Power to keep reading this post and get 7 days of free access to the full post archives.