Robinhood vs. eToro: One Platform Builds, the Other Drifts

In 2025, retail brokerage is not a feature — it's a fight for infrastructure dominance.

In 2025, retail brokerage is not a feature — it's a fight for infrastructure dominance. Robinhood and eToro may appear to play in the same sandbox, but their business models, product strategies, and market trajectories are fundamentally misaligned.

Robinhood is building a financial OS for the next generation. eToro is still selling tools for a previous cycle.

Robinhood: The Business, Not the Brand

Strip away the meme-stock stigma and what’s left is a financial platform with:

$232 billion in customer assets

25.9 million funded accounts

$1.7 billion in EBITDA (TTM)

A product stack that monetizes behavior, not just transactions

Monetization Stack:

Interest Income (Float)

$16B+ in customer cash, earning spread. This is now Robinhood’s largest revenue line — capital-light, scalable, and anti-cyclical.

Options Trading

High-frequency, high-margin, culturally sticky. Options generate disproportionate revenue and user retention.

Gold Subscriptions

$5/month to unlock higher margin, deeper data, and enhanced cash yields. Over 1.5M users, growing ~70% YoY.

IRAs + Retirement Products

$16B+ in retirement assets. This is Schwab’s model, rebuilt for mobile-native investors.

Card & Spending

Debit card with direct deposit, 3.9% yield on uninvested cash (Gold). Robinhood earns on spend, hold, and lend.

This is not a trading app.

It’s a vertically-integrated monetization engine where each feature reinforces another — asset retention feeds interest income, Gold feeds margin, margin feeds trading, trading feeds option volumes.

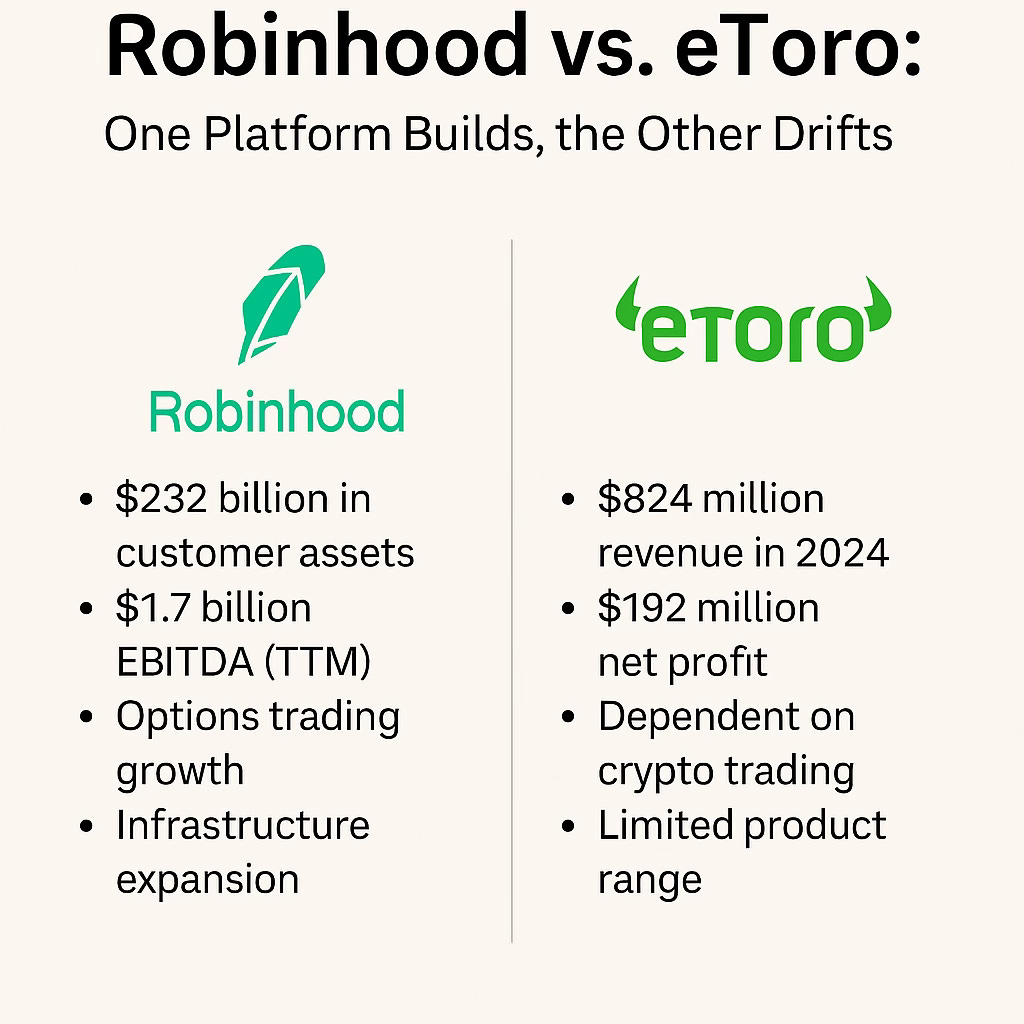

eToro: Global Reach, Shallow Yield

eToro’s topline sounds strong:

$824M in 2024 revenue

$192M in net profit

3.5M funded accounts

Users in 100+ countries

But that’s where it stops.

eToro's Model:

Spreads + overnight fees on trades

Social copy trading mechanics

Revenue linked heavily to crypto volumes

No penetration in U.S. equity or options market

No infrastructure layer (cards, retirement, margin, custodial)

The “social trading” model worked in 2017–2020. But that community dynamic is now decentralized: Reddit, Discord, Telegram, and Threads handle what eToro was designed to own.

There is no defensible moat, no unique monetization channel, and no real asset capture.

ARK Invest bought in post-IPO. But the position was small (~$9.4M), speculative, and hasn’t scaled. eToro hasn’t announced U.S. expansion, hasn’t launched any new monetizable product, and remains structurally outside the most profitable markets in brokerage.

Strategic Divergence

While eToro sits still, Robinhood is buying infrastructure:

TPR Acquisition — custodial tech for RIAs, pushing toward managed assets

WonderFi (Canada) — a $250M crypto brokerage buyout for regulated expansion

Crypto rollout in Europe, tokenized securities pipeline for E.U. clients

Options volume share growing — Robinhood has made options the entry point for a generation of investors

Even Coinbase has entered infrastructure-buying mode — $2.9B for Deribit to dominate crypto options.

Robinhood is executing that same logic — in traditional finance.

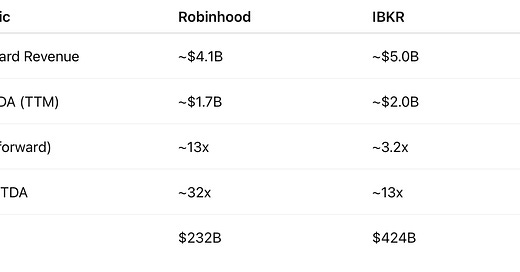

Robinhood vs. IBKR & Schwab: The Valuation Premium

Robinhood trades at a premium because of growth velocity + behavioral lock-in.

IBKR and Schwab manage more assets, but serve an older, slower-moving clientele

Robinhood’s user base is younger, more option-driven, and has higher frequency

The market is pricing in not just revenue — but lifetime value expansion + product density per user

In short: IBKR monetizes assets. Robinhood monetizes behavior.

Robinhood vs. eToro vs. IBKR – What the Valuation Actually Means

Robinhood has climbed 52% YTD and now trades at ~13x forward sales.

That’s aggressive for a brokerage. But Robinhood isn’t just a brokerage anymore.

It’s building infrastructure: cards, IRAs, crypto, options, and even custody. It earns like a fintech bank, retains like a broker, and grows like a SaaS company. That’s what gives it multiple expansion.

eToro, by contrast, hasn’t built the second layer.

It has social mechanics — but no platform stickiness. Its main monetization channel is still crypto-driven trading spreads. No U.S. options, no retirement product, no card. Its public listing didn’t fix the business model. Until it expands into the U.S. with real product depth, it's a nice trading frontend — not an investable platform.

IBKR is in another league.

It’s profitable, has $400B+ AUM, and grows slowly — but steadily. Revenue per client is in the thousands. But it’s not a growth story anymore. It’s infrastructure for serious capital. If you want a dividend compounder with no excitement — IBKR is the cleanest play.

What’s Priced In?

Robinhood is being valued like a platform, not a broker.

eToro is priced like a bet — and right now, it’s a passive one.

IBKR is priced like a mature compounder — lower risk, lower upside.

Your Edge

If you're long Robinhood now, you’re betting:

That younger investors don’t churn as they age.

That IRA + card products retain capital, not just flows.

That Gold subscriptions scale into Schwab territory.

Upside exists. But it’s already a $55B company — this isn’t $8/share HOOD anymore.

If you're looking for return asymmetry, you either wait for a correction or scale in slowly.

If you want certainty, Robinhood isn't for you — IBKR is.

Keep reading with a 7-day free trial

Subscribe to The Edge of Power to keep reading this post and get 7 days of free access to the full post archives.