War Profits: 5 EU Defense Stocks to Watch

Geopolitical tensions are rising. These 5 EU stocks could skyrocket 🚀

Tomorrow, the EU will hold yet another "crucial" summit to boost defense spending. But as always, the bloc struggles to find common ground. Aligning the capabilities and expectations of countries that historically neglected defense spending is proving difficult, and a unanimous decision may be out of reach due to opposition from Hungary and Slovakia. The EU lacks strong leadership, decision-making takes years, and its long-standing reliance on the US security umbrella is no longer an option.

Amidst this gridlock, Germany isn’t waiting. Breaking away from long-standing budget constraints that restricted defence spending, Berlin has taken decisive action. Markets reacted instantly—DAX surged 3.5% on the news, while bonds retreated at a pace unseen since the fall of the Berlin Wall. A symbolic shift. With Germany set to pour far more into defense, NATO-related stocks are soaring. French President Emmanuel Macron announced a meeting of European army chiefs in Paris next week, saying that Europe is in a "new era" probably without US help.

I’ve already covered 12 key defence stocks, and many have posted massive gains. But today, I’ve uncovered 5 more hidden gems—some of which might even make their American counterparts jealous.

1. Babcock International (BAB.L): The Backbone of Naval Defense & Military Services

Market Cap: £3.62B | Growth YTD: 42%

Babcock International is one of the UK’s most critical defense contractors, serving as the silent force behind the Royal Navy and NATO’s broader fleet operations. Specializing in naval maintenance, nuclear submarine support, and military training, the company plays a crucial role in keeping the UK’s strategic deterrence program operational.

The defense-focused business, which contributes over 70% of total revenue, drove Babcock’s solid earnings growth in 2024. Revenue rose 8% to £4.9B, reflecting increased demand for warship servicing and fleet modernization. Operating profit surged 12% to £440M, supported by efficiency improvements and cost-cutting measures. Babcock also made significant progress on its balance sheet, cutting net debt by £200M, giving it greater financial flexibility as global defense budgets expand.

The company remains deeply embedded in the UK’s nuclear submarine program, serving as the lead maintenance provider for the Dreadnought-class and Astute-class vessels.

Interesting fact: Babcock is responsible for maintaining Britain’s entire nuclear submarine fleet, ensuring continuous at-sea deterrence—a critical pillar of the UK’s defense strategy.

Babcock hiked its revenue expectations for the year 2025 to around £4.9B ($6.11B), on the back of strength in its nuclear and marine segments. As of February 4, the average analysts' forecasts was in the range from £4.51B to £4.78B. Babcock expects continued revenue growth as the UK and its allies increase naval spending amid rising geopolitical tensions. However, rising labor and material costs in shipbuilding could pressure profitability in the near term.

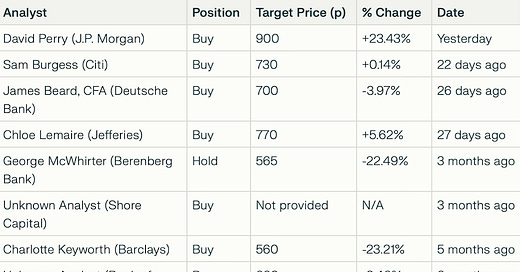

Stock Ratings and Target Prices.

Current price 729p

2. MTU Aero Engines (MTX.DE): Military Jet Engine Innovator

Market Cap: €19B | Growth YTD: +9.2%

MTU Aero Engines is a leader in military and commercial jet propulsion, powering advanced aircraft like the Eurofighter Typhoon and contributing to Europe’s Future Combat Air System (FCAS). Collaborating with global partners, MTU also supports U.S. fighter jet engines, such as the F414 and F110.

In 2024, MTU achieved record revenues of €7.5 billion (+18%) and adjusted EBIT of €1.05 billion (+28%), driven by strong demand for military engines and aftermarket services. For 2025, the company has raised its revenue guidance to €8.7–€8.9 billion, with EBIT expected to grow in the mid-teens percentage range.

With a robust order backlog of €28.6 billion and increasing defense budgets across Europe, MTU is well-positioned for sustained growth despite challenges like rising material costs.

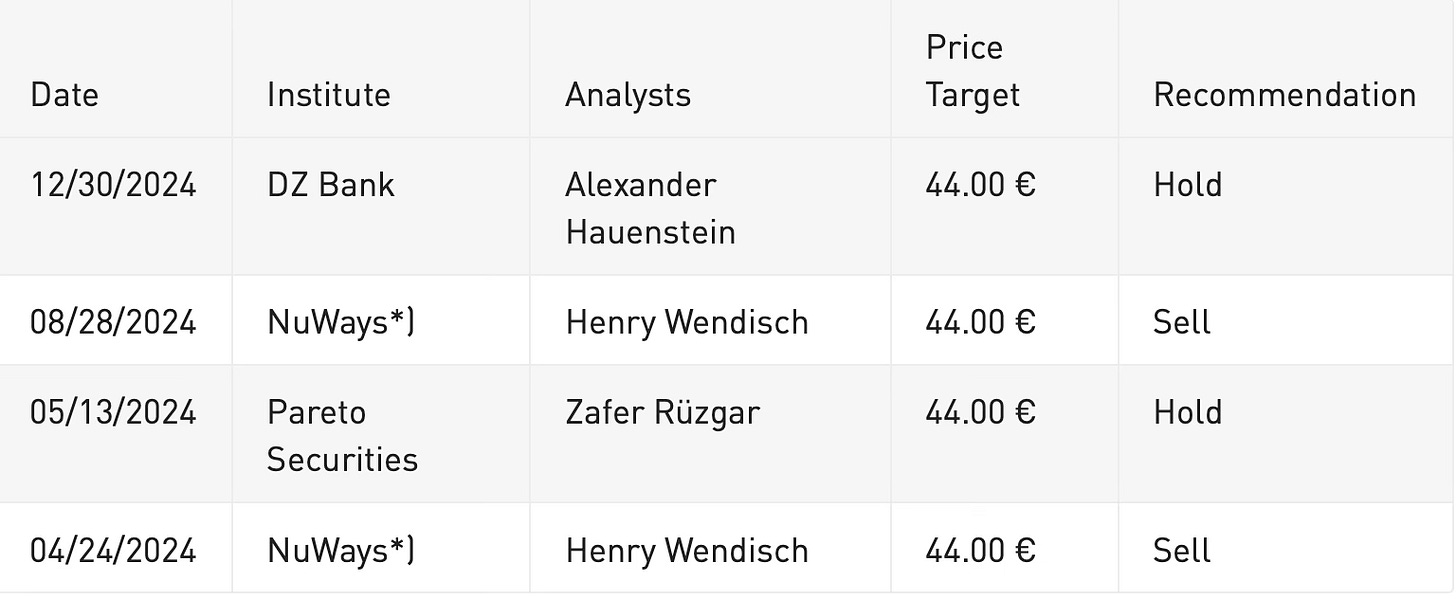

Stock Ratings and Target Prices

Current price €354

3. OHB SE (OHB.DE): Space & Military Satellite Powerhouse

Market Cap: €1.32B | Growth YTD: +45.76% | Current Price: €69.00

OHB SE is a leading space and technology company headquartered in Bremen, Germany, with over 40 years of expertise in satellite systems and aerospace solutions. The company operates across three segments—Space Systems, Aerospace, and Digital—delivering cutting-edge technologies for Earth observation, navigation, telecommunications, and reconnaissance. OHB is also Germany’s largest supplier to the Ariane program and a key player in satellite-based security systems.

Financial Performance

In 2024, OHB achieved revenues of €1.04 billion (+2.65% YoY) and reported an 82% surge in order intake to €1.7 billion, reflecting strong demand for its satellite and aerospace products. The company forecasts continued growth through 2027, supported by rising margins and expanding global partnerships.

Strategic Importance

OHB plays a critical role in European space exploration and defense, with projects like Galileo navigation satellites and microlaunchers for space missions. Its innovative solutions extend to urban AI applications using Earth observation data, showcasing its versatility beyond aerospace.

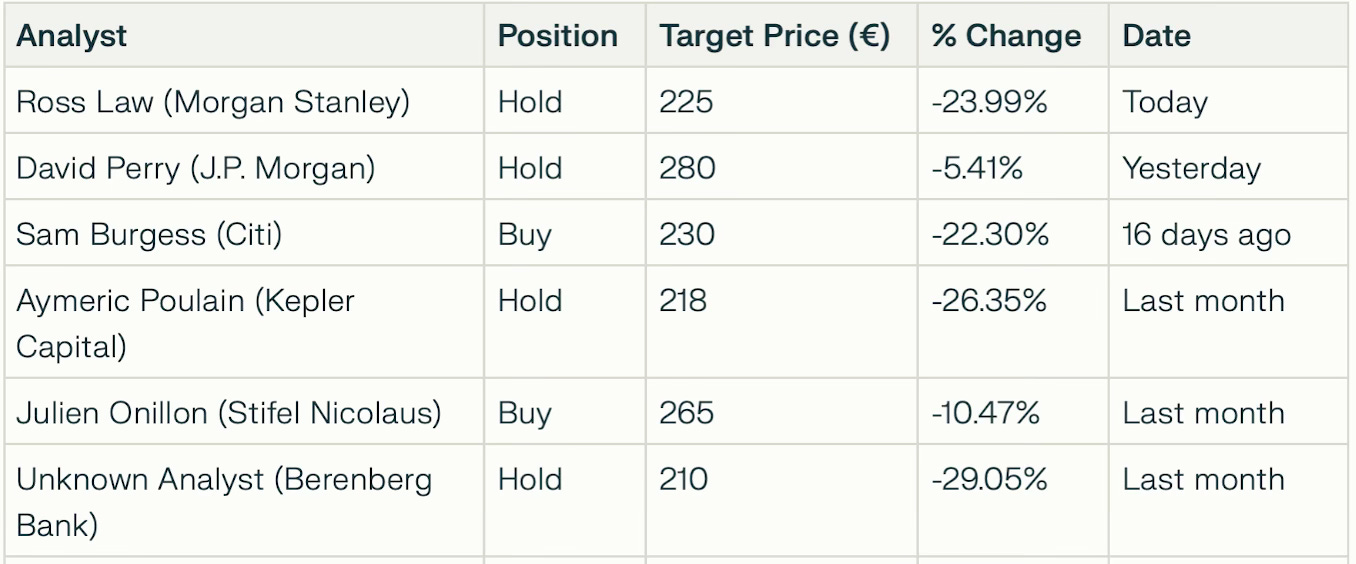

Stock Ratings and Target Prices

4.Dassault Aviation (AM.PA): Aerospace & Defense Innovator

Market Cap: €23B | Growth YTD: +46% | Current Price: €296

Dassault Aviation is a global leader in military and business aviation, renowned for its Rafale fighter jets and Falcon business aircraft. The company plays a pivotal role in European defense and aerospace, with a strong focus on innovation and sustainability.

Financial Performance

In 2024, Dassault reported revenues of €6.2 billion (+29% YoY) and adjusted net income of €1.06 billion (+19%). Operating margin improved to 8.3%, supported by lower R&D expenses and favorable foreign exchange rates. The order backlog reached €43.2 billion, driven by strong demand for Rafale jets (220 units) and Falcon aircraft (79 units).

Strategic Highlights

Delivered 21 Rafale jets (14 to France, 7 for export) and 31 Falcon aircraft in ‘24

Secured orders for 30 Rafales, including 18 from Indonesia and 12 from Serbia.

Outlook for 2025

Dassault expects revenues to rise to €6.5 billion, with planned deliveries of 25 Rafales and 40 Falcons. However, supply chain challenges remain a concern, prompting the company to invest in supplier support and alternative sourcing strategies.

5. Colt CZ Group SE (CZG.PR): Precision Firearms Manufacturer

Market Cap: CZK 25.92B (€1.08B) | Growth YTD: +11.61% | Current Price: CZK 3,130

Colt CZ Group SE (CZG), headquartered in the Czech Republic, is a leading European manufacturer of firearms for military, law enforcement, and civilian use. With a legacy spanning over 85 years, the company is renowned for its high-quality pistols, rifles, and tactical accessories under the Česká zbrojovka (CZ) and Colt brands.

Financial Performance

In 2024, Colt CZ Group reported revenues of CZK 14.86 billion (€622M) and net income of CZK 2.04 billion (€85M), driven by strong demand across its military and civilian segments. The company achieved a 19.35% growth in share price over the past year, reflecting its robust performance and market confidence.

Strategic Highlights

Global Reach: Colt CZ exports to over 90 countries, with significant markets in NATO member states and the U.S., where it operates a manufacturing facility in Arkansas. The company continues to expand its portfolio with advanced firearms like the CZ Scorpion EVO and Colt M5 carbines, catering to military and law enforcement needs.